Im filling out the FAFSA, and the question asks for line 1 on the 1040 which is wages, salary, tips etc. My dad is an independent contractor and his 1040 line 1

How to Enter 1099-MISC Fellowship Income into TurboTax - Evolving Personal Finance | Evolving Personal Finance

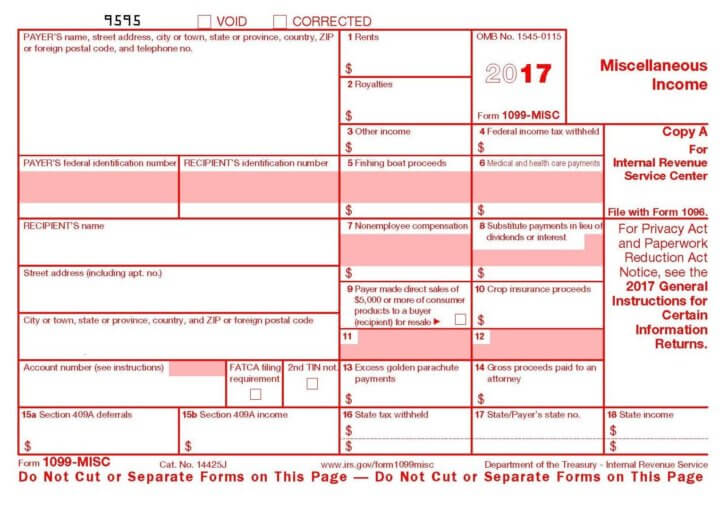

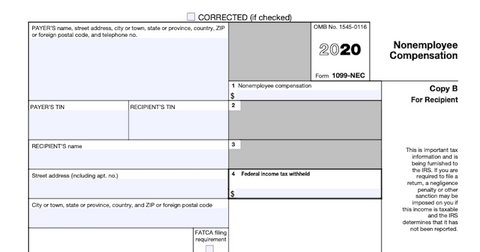

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

:max_bytes(150000):strip_icc()/1099-A-0151e1f82f624920b802b26d693d47f6.jpg)

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)